The Down Payment Myth is Costing You

You hear the number everywhere: 20% down. This old rule stops most first-time buyers from even starting their search. It is incorrect.

For most buyers in Central Maryland, saving 20% means waiting years while home prices continue to rise. We work in Howard County, Baltimore County, and across the state. We know the truth: you can buy a home today with much less.

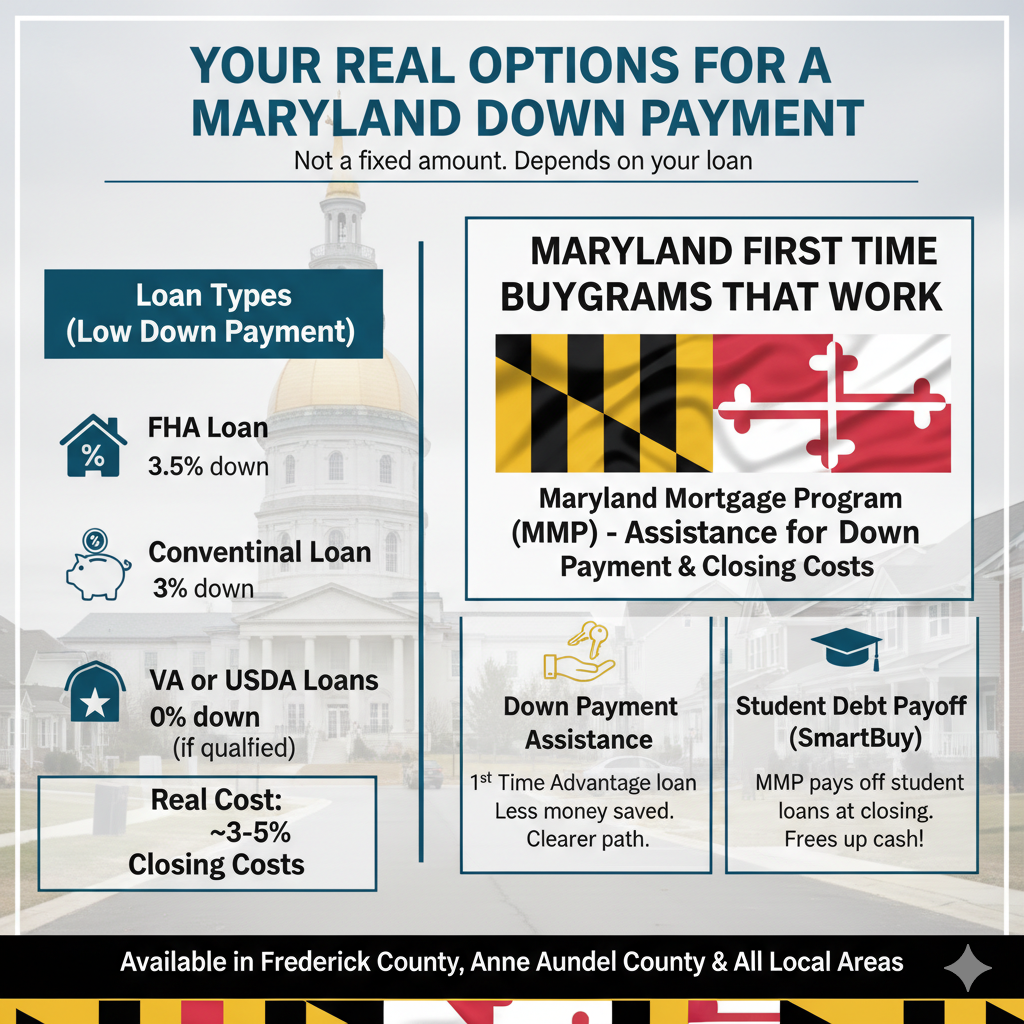

Your Real Options for a Maryland Down Payment

The amount of your Maryland down payment is not a fixed amount. It depends on the loan you choose. We focus on the facts and the loan types that work for first-time buyers:

- FHA Loan: You can buy a home with a down payment as low as 3.5% of the price.

- Conventional Loan: Some options allow for a down payment as low as 3% of the price.

- VA or USDA Loans: If you qualify (military service or rural areas), you could need 0% down.

The real cost to get started is often closer to 3% to 5% plus closing costs.

Maryland First Time Buyer Programs That Work

This is the key piece of information you need to know. Maryland offers first time buyer programs that are specifically designed to reduce your out-of-pocket cash. These programs are not a myth; they are a fact of the market.

The State of Maryland provides assistance through the Maryland Mortgage Program (MMP). This assistance can cover the down payment, the closing costs, or both.

Two Simple Programs to Know:

- Down Payment Assistance: MMP offers options like the 1st Time Advantage loan, which can provide funds toward your down payment and closing costs. This means less money saved and a clearer path to owning a home.

- Student Debt Payoff (SmartBuy): If you have student loan debt, the Maryland SmartBuy program can pay off those loans while you close on your home. This frees up major cash and reduces your monthly debt load.

These programs are available for buyers in Frederick County, Anne Arundel County, and all local areas we serve.

Your Next Move

Stop letting the 20% myth hold you back. You need local facts and a clear plan to secure your first home.

What to Do Now:

- Determine Your Real Budget: Use our mortgage calculator to see what 3.5% down looks like for you.

- Get the Facts: Talk to a lender who understands the Maryland down payment assistance programs.

- Get The Edge: Contact us to discuss your neighborhood and the first steps needed to move with confidence.

Ready to stop renting and buy your first home? Let's talk about the real numbers.